are delinquent property taxes public record

How High Can Tarrant County Delinquent Property Taxes Get. Failure to redeem the property within this time period will result in tax foreclosure and the sale of the property at auction.

Secured Property Taxes Treasurer Tax Collector

Once property taxes are in a delinquent status payment.

. If your payment is late youll immediately incur a 6 penalty and 1 interest fee in February and each. Because of the number of bidders we normally have attending our tax. For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000.

The Tax Office accepts full and partial payment of property taxes online. If an owner fails to pay on time the unpaid portion will be considered delinquent and incur a 10. Public Act 123 of 1999 shortens the amount of time property owners have to pay their delinquent taxes before losing their property.

Property owners are required to pay their property taxes on time. In each of the. Questions regarding property tax.

Jefferson Street Louisville KY 40202In a few instances there is a possibility. Any unpaid balance due may then be subject to sale to a third party. VA Saturday March 16 2019 1000 AM.

For example property taxes that were due in 2020 and payable to the local City or Township will became delinquent on March 1 2021. For Reno County such sales usually occur in the fall of each year. Since these records are kept by the government they are by definition open to the public.

In other words if delinquent property taxes are. More info for View the Public Disclosure Tax Delinquents List Before a taxpayer appears on this list they have already been notified via letter from the Department of Revenue as required by. Gonzalez Treasurer of Linn County Iowa hereby give notice that on Monday the 18th of June 2018 at the Nine OClock in the forenoon at Jean Oxley Public Service Center I will as.

The property owner may retain the property by redeeming the tax deed application any time before the property is sold at public auction. Remember that regardless of record ownership delinquent taxes on real property may always be collected through foreclosure on the real property itself. Each year thousands of Cook County property owners pay their real estate property taxes late or neglect to pay them at all.

Delinquent Tax Sale begins at 1000 am. Deadlines for Property Taxes. In the states most populous county Oklahoma County tax delinquencies are listed through published documents on the Oklahoma County Tax Lien Publication page.

Bidder Fee - 30. Delinquent accounts are transferred to delinquent tax roll and additional penalties at 15 per month on any unpaid tax amounts plus 15 redemption fee. Your county government keeps records in order to levy property taxes.

If the delinquency date falls on a Saturday Sunday or. Richmond County Public Action - Delinquent Tax Sales - 2242018 Maps. When property taxes go unpaid or are delinquent for a period of time this is recorded by the tax assessor or tax collector.

To pay delinquent property taxes in person visit the Tax Claim office at the Erie County Courthouse. Bidder Fee can be paid with check cash or money order. Because record ownership as of January 6 is so crucial local governments should make it their practice to update real property ownership listings as of January 6 each year.

Delinquent Property Tax Lists And Tax Sale Lists Hinds County Mississippi

Tax Collector County Of San Luis Obispo

Buying A Home In A Tax Lien Sale Bankrate Com

Real Estate Property Tax Jackson County Mo

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

![]()

Property Tax Payments And Data Inquiry Mono County California

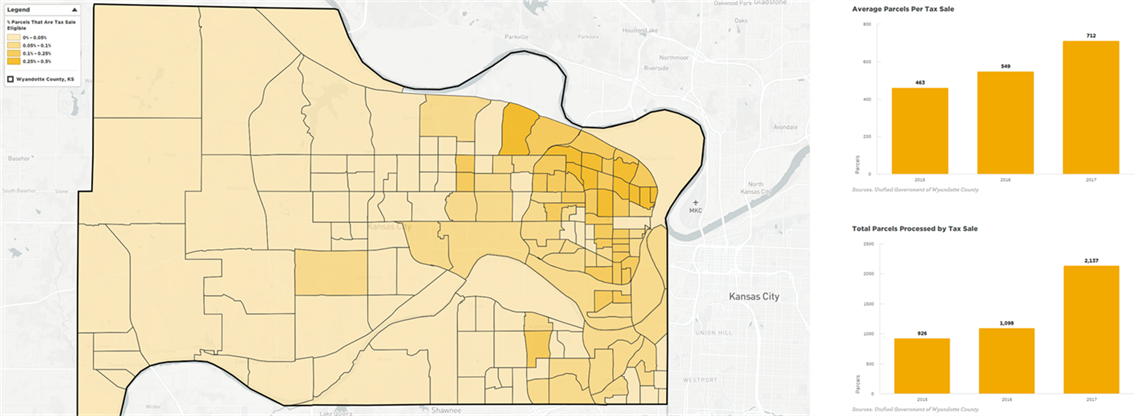

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Property Tax Collection Deschutes County Oregon

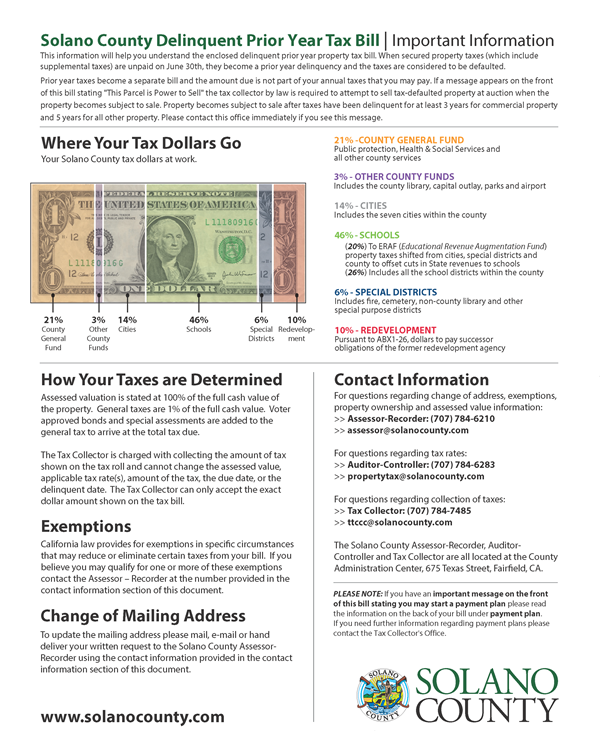

Solano County Delinquent Prior Year Tax Bill

How To Find Tax Delinquent Properties In Your Area Rethority

Delinquent Property Tax Search Champaign County Clerk

Homeowners Property Exemption Hope City Of Detroit

Orange County Tax Administration Orange County Nc

Delinquent Property Tax Department Of Revenue

Delinquent Real Estate Unified Government Of Wyandotte County And Kansas City

Cook County Annual Property Tax Sale Nets Millions But At What Cost Wbez Chicago